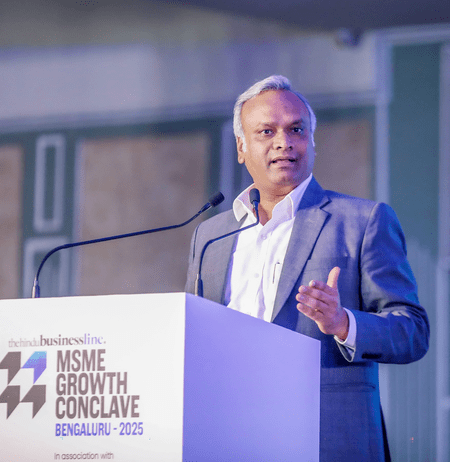

Bengaluru, Sep 4 — Karnataka Minister for Rural Development and Panchayat Raj (RDPR), IT and BT, Priyank Kharge, has criticised the Centre’s revamp of the eight-year-old Goods and Services Tax (GST) regime, arguing that it continues to burden the poor and middle class while giving relief to corporates and the wealthy.

“Two-thirds of the total GST, i.e. 64 per cent, comes from the pockets of the poor and middle class. Barely 3 per cent GST is collected from billionaires, while corporate tax has been reduced from 30 per cent to 22 per cent,” Kharge said on Thursday.

He added that while the government has finally moved towards rationalising and simplifying GST, it has yet to explain how states like Karnataka will be compensated for revenue losses.

Taking to social media platform X, Kharge described the reform as overdue. “A bit of common sense seems to have dawned upon the Narendra Modi Sarkar on the ‘Gabbar Singh Tax’. For almost a decade, the Congress has demanded simplification of GST. ‘One Nation, One Tax’ had become ‘One Nation, 9 Taxes’ — 0 per cent, 5 per cent, 12 per cent, 18 per cent, 28 per cent, and special rates of 0.25 per cent, 1.5 per cent, 3 per cent and 6 per cent,” he wrote.

He recalled that Congress leaders Rahul Gandhi and Mallikarjun Kharge had consistently demanded an 18 per cent cap and a rationalised GST. The party’s 2019 and 2024 manifestos also called for “GST 2.0” with simpler compliances to ease the burden on MSMEs and small businesses.

Kharge further alleged that under BJP rule, even farmers were taxed, with at least 36 agricultural items brought under GST at rates between 12 per cent and 28 per cent. Essential commodities like packaged milk, wheat flour, curd, books and stationery were also unfairly taxed, he added.